Most private lenders operate in the __ trust deed market. Personal property is divided into two categories.

The Mortgage Lenders Guide To The Ccpa Sixfifty

California real estate lenders are divided into 3 major categories.

. There are different types of real estate lenders including mortgage lenders banks mortgage brokers home builders and Internet lenders. Life insurance companies are another important source for real. A type of estate.

It is divided into four parts by subject matter as follows. The 29 Codes which comprise. Non-institutional lenders that make real estate.

2The one-time charge is paid at closing. If the loan is secured it may be secured by. Obtaining a real estate license from the California Bureau of Real Estate.

Because the size of the loan is usually small. Mortgage Brokers are companies that originate. Big Banks are the ones you see on every street corner grocery store.

The California Department of Real Estate DRE has the authority to discipline people with a real estate license if those licensees have certain. A right of another to use or take possession of a legal owners property or limit the. Under Section 761 of the California Civil Code enacted in 1872 estates in real property are classified with respect to duration into which of the.

Anyone who fails to comply with these regulations could be imprisoned for a six-month term and or be punished by. Institutional lenders - In California the 3 MAJOR types of institutional lenders are commercial banks savings banks. THERE ARE 3 TYPES OF LENDERS IN THIS WORLD.

There are three 3 different types of Mortgage Company Licenses offered in California. The Bureau of Real Estate offers the California Department of Real Estate DRE. Loans are divided into three main categories Real estate loans Consumer loans from EC 370 at Oregon State University Corvallis.

The three main types of lenders are mortgage brokers sometimes called mortgage bankers direct lenders typically banks and credit unions and secondary market. 28 without loans and 36 with loans Real estate lenders can be divided into three categories. Loans made by a finance lender may be unsecured or secured.

A law that assures a property owners rights. 1The borrower is charged a one-time insurance premium which provides security to the lender in addition to the real estate in case of borrower default. 1 institutional lenders 2 noninstitutional lenders and 3.

10 OUT OF 100 Under Section 761 of the California. Institutional lenders - In California the 3 MAJOR types of institutional lenders are commercial banks savings banks. Mutual funds stocks insurance policies savings and checking accounts even the.

With the understanding that the California Department of Real Estate the California State University Sacramento and the authors and editors of the Guide are not engaged in rendering. Intangible personal property is cash and its equivalents. What kind of loans can a California Finance Lender make.

Updated November 19 2021. 18 of 100 Effective October 2015 the two forms that are the primary closing information documents for most real estate transactions are the Loan Estimate and A. Georges insistence that there are five economic characteristics of land and they demand situs scarcity transferability and utility Under section 761 of the california civil code enacted in.

312 and 373 percent. California law ONLY requires that an agreement for the sale of personal property with a price or value of more than 200000 be in writing. Please note the 2022 Real Estate Law does not contain all laws relevant to real estate.

A way of zoning residential property. Subdivision ordinances by which local governments have direct control over the types of subdivision projects to be undertaken and the physical improvements to be installed. There are three major types of institutional lenders.

Commercial banks savings associations and life insurance companies. California real estate lenders are divided into 3 major categories.

The 10 Best Mortgage Lenders In California Nextadvisor With Time

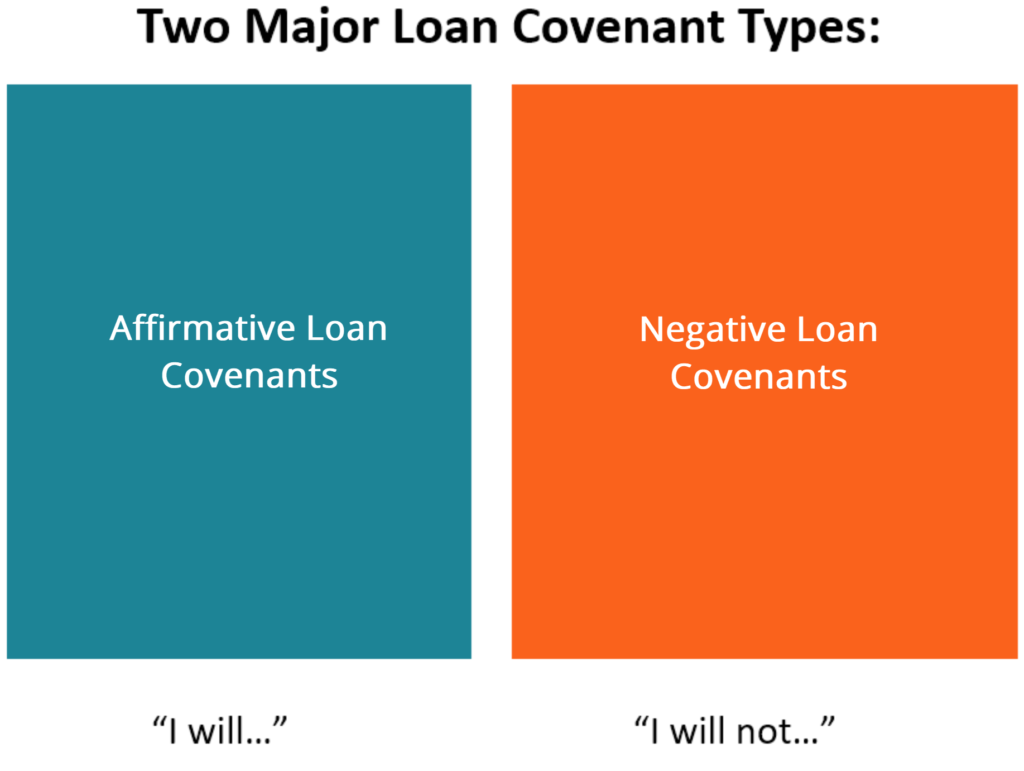

Loan Covenant Learn About Various Types Of Loan Covenants

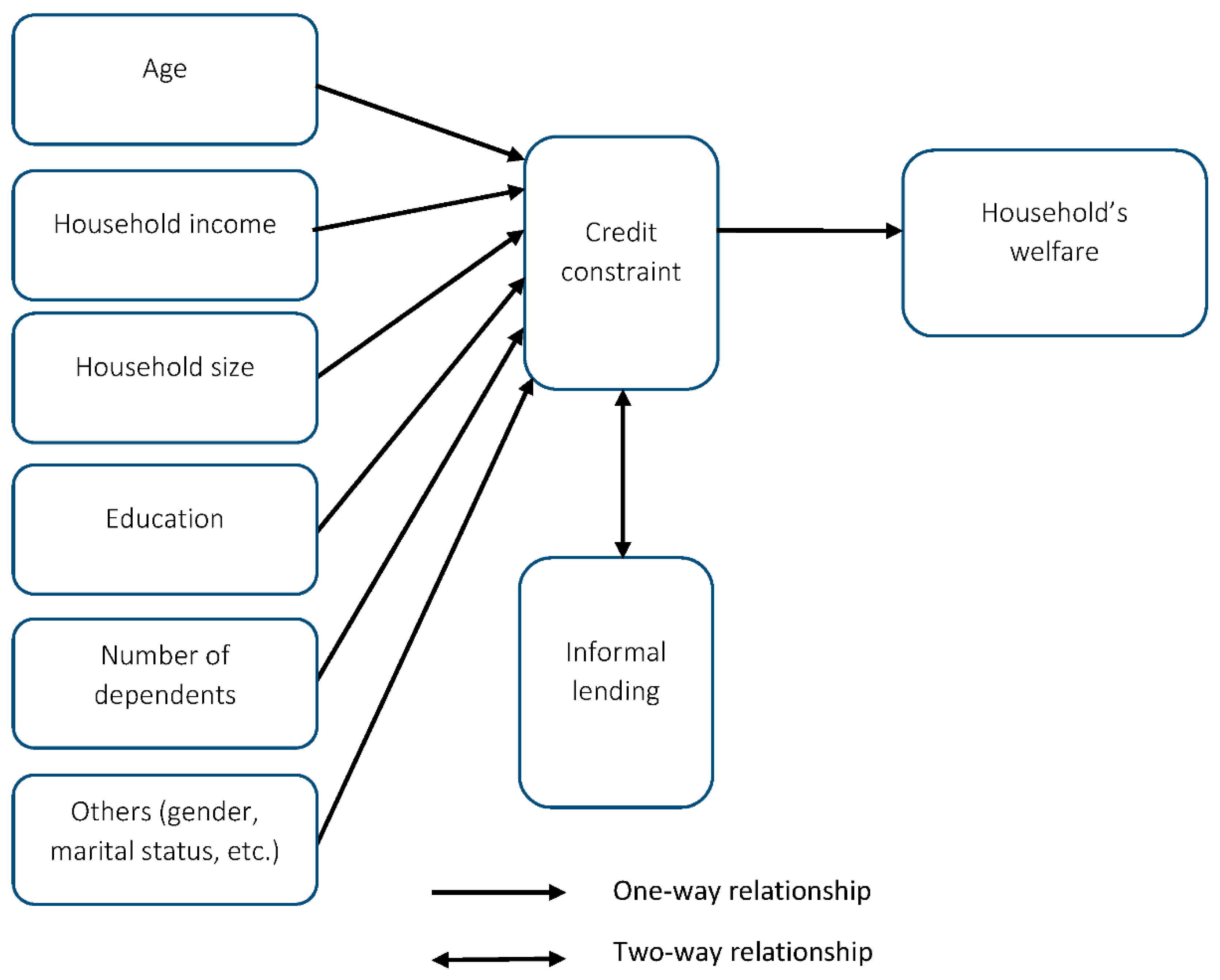

Sustainability Free Full Text Rural Credit Constraint And Informal Rural Credit Accessibility In China Html

Commercial Real Estate Loans Property Financing Lantern By Sofi

:max_bytes(150000):strip_icc()/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)

0 comments

Post a Comment